The Indian market for perimeter intrusion detection and prevention is on a strong and sustained growth trajectory, but this expansion is not being captured uniformly across all technology segments or by all market players. A strategic analysis of the India Perimeter Intrusion Detection Prevention Market Growth Share by Company and by technology type reveals a clear and powerful trend. The fastest-growing segments are those that leverage more advanced and intelligent technologies, particularly AI-powered video analytics, radar, and integrated, multi-sensor solutions, while the growth in older, more basic technologies is more modest. The companies and system integrators who are most successfully capturing this growth share are those that can offer a more proactive, lower-false-alarm, and more data-driven solution. The India Perimeter Intrusion Detection Prevention Market size is projected to grow USD 1.34 Billion by 2035, exhibiting a CAGR of 9.81% during the forecast period 2025-2035. Understanding how this substantial growth is being allocated is key, as it highlights a fundamental market shift from simple alarm-based detection to a new paradigm of intelligent assessment and automated response, driven by the need to secure ever-larger and more complex perimeters against a growing range of threats.

A disproportionately large share of the market's growth is being captured by solutions that incorporate AI-powered video analytics. Traditional video surveillance for perimeters was a passive, reactive tool, requiring a human operator to constantly watch multiple screens. The new generation of video analytics is transforming it into a proactive, automated detection system. The growth is flowing to companies that provide software that can analyze video feeds in real-time to automatically detect and classify potential intrusions—differentiating between a human, a vehicle, and an animal—and to track targets as they move along a perimeter. This dramatically reduces the number of false alarms and allows security operators to focus on genuine threats. This technology is being deployed both at the high end, for securing large critical infrastructure sites, and is also becoming more accessible for commercial applications. The ability to turn a standard security camera into an intelligent perimeter sensor is a powerful value proposition that is driving a massive share of the new spending in the market.

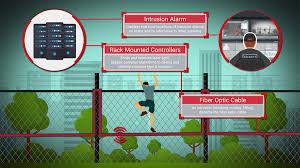

While video analytics captures a huge share of the growth, another significant area of expansion is in the adoption of more advanced sensor technologies like radar and sophisticated fiber-optic systems, particularly for high-security applications. Ground-based radar systems are capturing growth for securing large, open areas like airports and industrial plant perimeters, as they can provide reliable detection over long distances and in all weather conditions, with a very low false alarm rate. Advanced fiber-optic fence detection systems, which can pinpoint the exact location of an intrusion attempt along a perimeter fence that may be many kilometers long, are also seeing strong growth for securing borders and critical infrastructure. The growth share is also flowing towards the system integrators who can successfully combine multiple different sensor technologies—for example, a fence sensor, a radar system, and a thermal camera—into a single, unified "layered" security solution. This multi-sensor, data-fusion approach provides a much higher level of security and a lower false alarm rate than any single technology can achieve on its own, and the ability to deliver this integrated solution is a key driver of growth for the most sophisticated players in the market.

Top Trending Reports -

Japan Relational Database Market